Healthcare technology companies are at the forefront of innovation, developing cutting-edge solutions with the potential to revolutionize care delivery, health outcomes and healthcare inequities. Yet, these companies often face substantial challenges in achieving sustainable profit.

In the past, when capital was cheap and valuations were astronomical, start-ups were rewarded by capital markets, venture capitalists and private equity leaders who emphasized a “growth at all costs” mentality. Since then, a big correction in tech valuations has taken place as the venture equity and debt markets have gone dry.

In addition to challenging market conditions, healthcare start-ups contend with myriad issues ranging from high development costs and regulatory hurdles to market adoption, user acceptance and reimbursement barriers.

Earlier in the year, we announced to the Street that we were on track to achieve breakeven EBITDA in Q4 2023 on an adjusted basis, a great proxy for our ability to generate self-sustaining cash flow. Despite formidable challenges, Dialogue will be one of the few healthcare technology companies in the world to scale beyond $100 million in annual recurring revenue (ARR) while achieving a sustainable, cash-generating business model.

These are the key factors which have contributed to the successful growth of our topline and our ability to generate cash flow.

1. Cost structure discipline and platform scalability

We continue to optimize our cost structure and remain disciplined on capital allocation to improve unit economics as we scale. We make investments in technology to drive automation and process improvements, and strike an optimal balance between delivering the best member experience and the best service levels in the most cost-effective way possible. Most of our operating expenses below gross profit are now largely at scale, which allows Dialogue to drive operating leverage.

With 75+ tech and product employees and 100+ software releases per week, we have built a formidable engineering muscle. When it’s advantageous from a strategic or cost structure perspective, we develop vertically integrated solutions to bolster our platform and operating model.

Our solutions can also handle an increasing number of users or workload without a proportional increase in costs. Scalability helps us serve a larger customer base and increase revenue while controlling costs. Scalability also extends to individual functions like Go-to-Market (GTM) where we’ve taken a variety of actions to improve our sales motion over time. Investments in technology, talent, process standardization and training have been foundational.

2. Gross margin enhancements

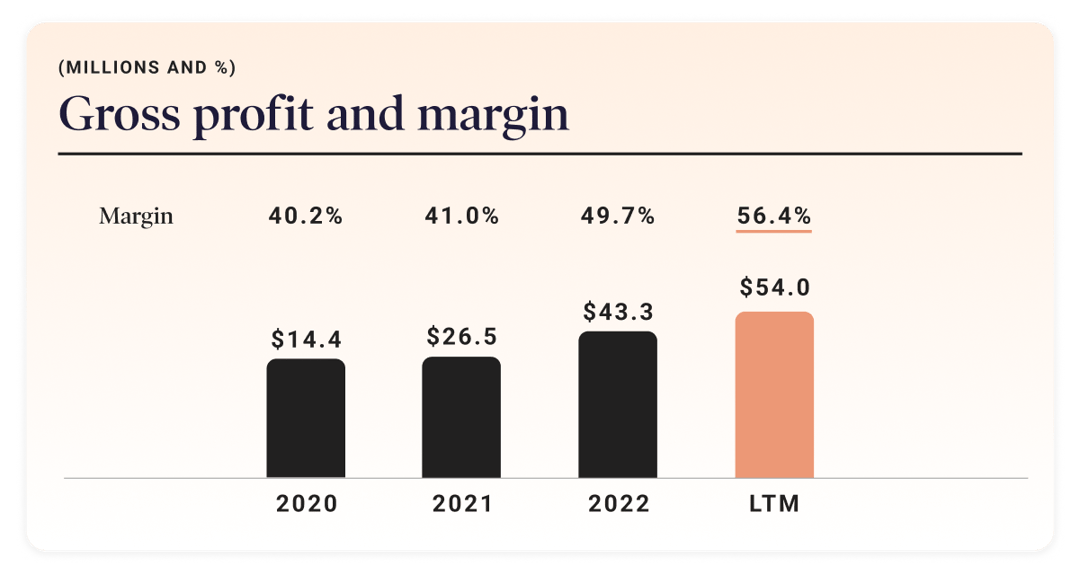

We’ve achieved gross margin expansion as the business has scaled, which is driven by pricing, economies of scale and a focus on continuous improvement through efficiencies and automation. These enhancements have driven an increase in gross profit dollars from $14.4M prior to IPO to $54.0M over the last 12 months (LTM). Dialogue has also driven sequential improvements in gross margin on an annualized basis.

3. Large account penetration to help drive stronger deal math

Over time, we’ve pushed ourselves to pursue larger customers as quickly as possible. Small deals helped us to get started, but big deals are now driving growth. Larger deals allow us to focus on driving more revenue while exerting less effort, and help customers become more successful through additional support in areas such as Customer Success. Due to our strong channel partnerships, we have gained significant scale in the small and mid-market with smaller GTM investments. This enables us to focus our direct GTM investment on the large enterprise segment.

4. Customer life-time-value (LTV) maximization

We are customer-obsessed and focus on retaining existing customers, since it’s often more cost-effective to retain a customer than to acquire a new one. In Q2, our net retention rate was 120%, which illustrates that not only are we retaining customers, but we are also increasing the share of wallet that our customers are spending on Dialogue’s services.

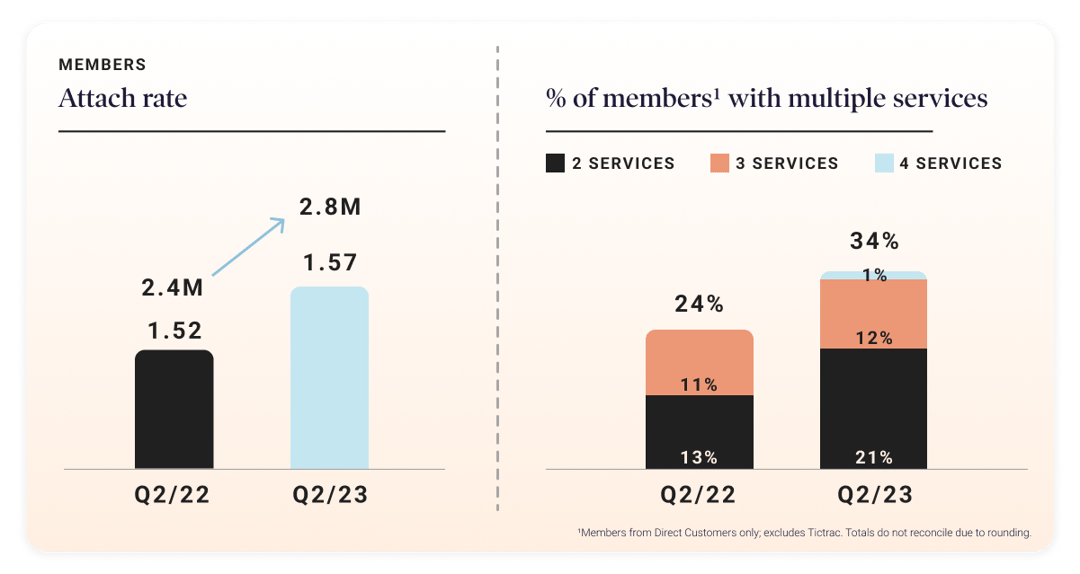

Increasing our attach rate, which is the number of services we sell to the same customer, not only helps enhance our growth and profitability profile, but also has the potential to improve “stickiness” and decrease churn risk. In Q2 2023, 34% of members had access to multiple services, which is up from 24% in Q2 2022. We are focused on perpetuating this trend. Our existing book of business provides a significant runway to drive LTV by cross-selling and up-selling products and services with limited incremental sales and marketing expenses.

5. Higher-margin services

Over time, we have supplemented the strength of our tech-enabled service model by launching software-as-a-service (SaaS) products. Increasing the volume and mix of higher-margin services results in gross margin and EBITDA expansion. It also puts us closer to achieving our big hairy audacious goal, helping people one million times per week, by placing self-serve tools into the hands of our members. SaaS services drive members back to our Integrated Health Platform, which leads to higher levels of engagement with their own health and wellness.

6. Geographical expansion

We are proud to announce that we have successfully penetrated the $4.2 trillion dollar (USD) healthcare juggernaut south of the Canadian border. We are now licensing our platform in the US and intend to offer our wellness program to a minimum of 600K members in the US in the next year.

Achieving sustainable profit is a significant challenge for healthcare technology companies. However, with strategic planning and execution, these challenges can be overcome, paving the way for success in this rapidly evolving industry. By establishing a sustainable and profit-generating business, we can keep investing to reach our goal of helping one million people per week. We are passionate about helping people improve their well-being, and we are on the verge of another important milestone in our journey.

Canada (EN)

Canada (EN)

Global (EN)

Global (EN)