This article is for educational purposes only and does not constitute financial advice.

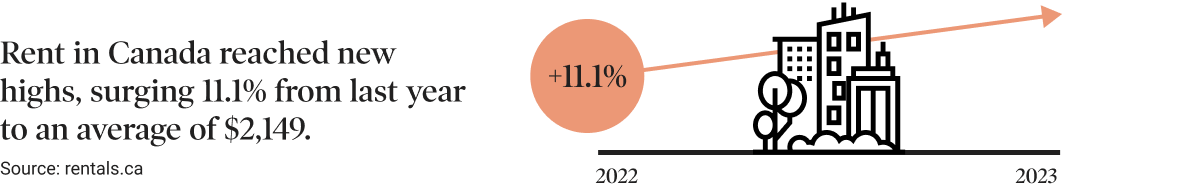

Financial stress among working Canadians has shot up by 20% compared to last year. With rising costs, inflation, and volatile economic conditions, this is no surprise.

In this article, we discuss practical guidance and emotional support to help you manage your finances during these trying times. By implementing these tips, you can regain a sense of control and alleviate some of the stress, whilst taking positive steps towards a brighter financial future.

Practical considerations

Educate yourself and stay adaptable

Knowledge is power, and that’s particularly true when it comes to navigating your finances. The better you understand the current financial landscape, policies, and key shifts, the more you’ll be able to make informed decisions about your finances.

Set aside some time to look into the information on offer. Whether that’s listening to financially focused podcasts that break things down into bite-sized chunks, or making a point of reading the finance section of your favourite – and most trusted – paper. Understanding the context for the challenges you face can only help improve your situation in the long term.

Analyze your budget and prioritize expenses

You can’t decide where to cut costs if you don’t know what you’re spending, so understanding your take-home pay and bills is key. Schedule a quiet afternoon to review your current budget and identify areas where you can make adjustments.

When you do, it's crucial to discern between essential and non-essential expenses. By focusing on meeting your basic needs and allocating your resources accordingly, you can better manage your finances, ensuring you can accommodate the rising costs of necessities and even put a little aside for non-essential treats in the future.

.png?width=1128&height=415&name=Essentials%20vs.%20Non-essentials_EN%20(1).png)

Meal plan and shop wisely

Many of us do our weekly groceries on autopilot, which means we could be missing bargains that can help us save money in the long term. Practical ways to reduce this kind of spending include:

-

Using coupons

-

Opting for canned or frozen meat and vegetables over fresh

-

Diversifying the cuts or types of protein you choose.

You could also consider meal planning, which will help you research cheaper ingredients ahead of time and avoid food waste, minimizing your grocery bill without compromising on nutrition. By taking the time to research your shop and make more cost-conscious choices, you can still enjoy fulfilling while being mindful of your budget.

Explore income-generating opportunities

If you have the time, you could consider supplementing your primary income by freelancing, taking on part-time work or starting a side business that aligns with your skills and interests. This can help alleviate financial strain, while also developing your talents in a way that could lead to additional career opportunities in the long term.

Invest in yourself

Investing in personal development can enhance your employability and potentially lead to better-paying opportunities and career growth. Better still, you can do it for free! Speak with your manager about funded training opportunities offered by the company, or check out the free courses and training available online, for maximum impact with minimal spend.

Negotiate bills and expenses

Did you know that negotiating bills such as utility costs and insurance premiums can secure more favourable terms and reduce your overall expenses? Make a list of your current providers, then schedule some time to research deals or lower-priced plans available, whether with them or competitors. Remember, better prices are sometimes available over the phone, so don’t hesitate to call and ask for advice on the options available.

Consider alternative transportation

With rising fuel costs, it might be worth considering alternative transportation options to mitigate expenses. If these are feasible, they can help you save money and reduce your carbon footprint.

Adopt energy-saving measures

Reducing energy consumption can help reduce your utility bills. It may require some upfront investment, but finding ways to make your home more energy-efficient, such as insulating properly, using energy-efficient appliances, and even adopting renewable energy sources, can help you save significantly in the longer term.

For many of us, making such major changes isn’t viable, but there are still small adjustments we can make. These simple actions can positively impact our energy bills, and work equally well whether you rent or own:

-

Taking shorter showers

-

Unplugging appliances rather than leaving them on standby

-

Switching to LED lightbulbs

Seek professional financial advice

Navigating the complexities of your specific financial situation can be challenging. That's why it may help to consult a financial advisor who can offer expert guidance tailored to your needs. They can suggest strategies to mitigate the impact of rising costs on your long-term financial goals, and even give advice on debt management and repayment plans too.

Lean on community support and resources

There are local organizations, community initiatives, and government programs that offer assistance with cost-saving measures if you need it. Make it a point to look into the resources and advice centres near you. They'll be able to advise on relief measures or subsidies you might be eligible for, and offer guidance to help support you during times of financial strain.

Explore alternative housing options

If you’re really struggling with increased rent or rising mortgage rates, it may be beneficial to explore alternative housing options that align with your changing financial circumstances. This could involve downsizing, refinancing, or finding different housing arrangements that suit your needs. It’s a big step and not suitable or viable for everyone, but looking at the options can help you pinpoint solutions you would otherwise dismiss.

Investigate debt relief

If you're burdened by existing debts, it's important to evaluate various debt relief options. This will help manage and alleviate the financial stress, allowing you to navigate the current economic landscape with greater ease.

Emotional considerations

Acknowledge the emotional strain

It's okay to acknowledge the stress and worry that come with financial challenges. By recognizing and accepting these emotions, you can start taking positive steps towards managing them.

Prioritize self-care

It may be the last thing on your mind if you’re feeling stressed, but taking care of your physical and mental well-being should be a priority. Allocate time for activities that help you unwind and relax, such as exercise, meditation, hobbies, or spending quality time with loved ones.

Create a support system

Surround yourself with a support system of friends, family, and support groups who can offer emotional comfort and guidance during these challenging times. Sharing your concerns and finding solace in others going through similar experiences can provide significant relief.

Get creative

Adopting a frugal lifestyle doesn't have to be dull or restrictive. Look for creative ways to save money:

-

Find free or low-cost entertainment options

-

Explore DIY projects

-

Discover new hobbies that don't break the bank

This will help you save money, but also ensure you maintain a way of life that’s enjoyable and that works for you.

Treat yourself with compassion

Reviewing your spending patterns or debt can be stressful. Rather than beating yourself up for past financial decisions or erratic spending, try to take a compassionate approach. Understand that your financial situation may have changed, and adjustments are necessary. Instead of feeling guilty or overwhelmed, focus on identifying areas where you can make reasonable cutbacks and modifications.

Celebrate small victories

Celebrate even the smallest financial victories along the way. Whether it's negotiating a lower bill or sticking to your budget for a week, acknowledge and reward yourself for your efforts. These small wins can lead to big improvements, plus they build momentum and help you stay motivated in your financial journey, all of which is worth celebrating.

Practice gratitude

It’s easy to feel weighed down by your financial situation, but you can help ease this pressure by cultivating a mindset of gratitude and appreciating the non-financial aspects of your life. Focus on the relationships, experiences, and simple joys that money can't buy. This shift in perspective can reduce anxiety and remind you of what truly matters. Here are a few examples of positive self-talk.

The current financial situation is a source of significant stress for many of us. However, by acknowledging your feelings, prioritizing self-care, and implementing practical strategies, you can navigate these challenges with more confidence and ease.

Remember, you are not alone in this journey, and with the right support and mindset, you can regain control of your finances and find peace amidst the economic turmoil. Stay resilient, take small steps forward, and trust that better days lie ahead.

Discover other tools to manage your mental health and well-being.

*Disclaimer: The information contained in this document is provided for informational purposes only, and should not be construed as legal or financial advice on any subject matter. You should not act on the basis of any content included in this document without seeking legal, financial or other professional advice. The contents of this document contain general information and may not reflect or address your situation. We disclaim all liability for actions you take or fail to take based on any content on this document.*

Canada (EN)

Canada (EN)

Global (EN)

Global (EN)